What is economic stress?

The term “economic stress” refers to the feeling of stress arising from your own financial situation or from your concern over the future of the economy. Although some stress can be beneficial, such as boosting your energy or helping you take the initiative to take needed actions, economic stress, especially among college students, can have harmful effects.

Several factors can trigger economic stress, including:

- Loss of a home or job

- Substantial changes in income and budget

- Feeling like you don’t have enough resources in comparison with others

- Working while attending college

A significant amount of financial stress can be caused by the perception that students have fewer financial resources than other students. Those who do not come from wealthy backgrounds can feel stressed and isolated when faced with the perception that “all students are wealthy.” This perception is not always true, but it can be challenging to find other students who have the same financial concerns you do.

There is no need to feel alone if you are experiencing economic strain. Financial stress negatively impacts the academic progress of 33 percent of college students nationwide.

Read: COVID-19 Stress

What are symptoms of economic stress?

The following are some of the common symptoms of economic stress:

- Sleeping problems

- Digestive issues

- Weight gain or loss that doesn’t make sense

- Inability to take part in daily activities

- Panic attacks or severe anxiety

A specific economic symptom may include an excessive focus on money concerns and avoidance behavior (e.g., letting unpaid bills pile up).

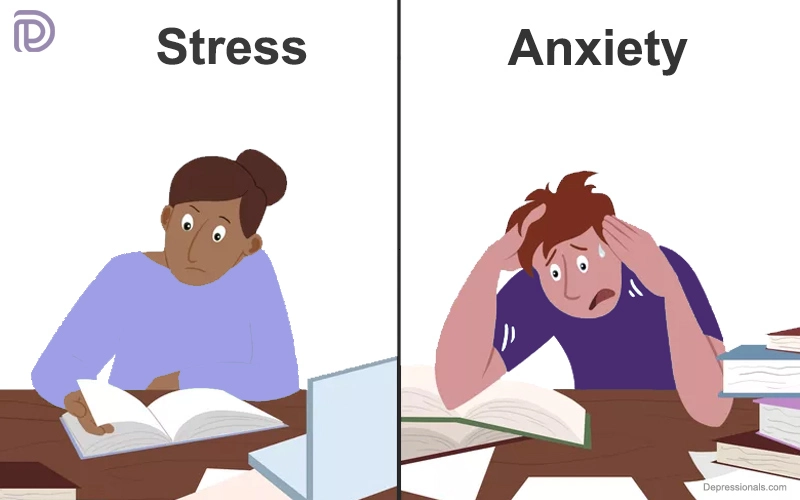

Economic stress can sometimes trigger symptoms. When struggling to cover living costs and college costs becomes more challenging, these flashpoints are more likely to occur. Stress can lead to tension between family members and friends, as well as cause or aggravate depression and anxiety.

Read: Chronic Stress Disorder

What are strategies to manage economic stress?

There are ways to reduce negative feelings associated with economic stress even if many of the factors aggravating the situation are beyond your control. You can manage your stress level and improve your financial situation by taking simple steps.

The following college students have rated the following resources as the most helpful based on a national survey:

- One-on-one financial counseling

- Seminars on managing money

- Student loan management seminars

- Online financial education

To reduce levels of economic stress, here are a few other basic strategies:

Prioritize and plan–you will feel more in control when you have a plan in place and are able to identify resources that support it.

- Identify options and resources with your parents to address your financial concerns.

- Be aware of how you spend each day and make changes where you can.

- If your family’s financial circumstances have changed significantly, contact the Office of Financial Aid. We can assist you and your family in identifying alternative payment options for your student account.

- A Career Lab can help you plan for the future if you are concerned about the impact of the financial market on job prospects.

Communication is crucial if you want to reduce tensions about money and make everyone feel safer.

- By discussing your financial worries with your family, you can learn whether your fears and concerns are reasonable.

- Family tensions about money can be reduced by communicating frequently about financial issues.

- Consult friends and faculty members on campus. Understanding that others also struggle with these issues and knowing their coping strategies can help you gain perspective on your own situation.

Related: 12 Simple Ways to Reduce Stress

It is stressful to be in a situation in which you have no control. Do what you can, then move on.

- Be patient while your finances change.

- You should practice letting go of worries one or two times each week after you limit your worrying time. The more you worry about a situation despite doing all you can to improve it, the more stressed you will become.

You should try to change your focus to other important parts of your life so as to stop worrying about your financial situation.

- Take advantage of free or inexpensive opportunities to do the things you love.

- There are many free events and activities on campus.

- Work hard in your favorite class.

- Take time to relax with friends.

Positive thinking is powerful.

- Concentrate on positive outcomes and ideas.

- Look for your strengths, not your weaknesses, and look for opportunities rather than fears.

- Every day, spend a few moments affirming that you will overcome any obstacles that come your way, and keep in mind the good times that are ahead.

Read: Stress Response Syndrome

What are some warning signs that I need help coping with my stress?

The symptoms of stress overload can range from an overall feeling of drowsiness to physical pain. The following warning signs may indicate you should seek help before reaching a crisis point. However, most stress can be managed. You should seek professional support if you experience any of the following circumstances or feelings.

Behavioral symptoms:

- Overreacting to small issues

- Getting angry or impatient inappropriately

- Losing appetite or overeating

- Drinking more alcohol or smoking tobacco

- Lack of relaxation

- Feeling anxious constantly

- Constantly bored

- Disrupted sleep patterns

- Problems in intimate moments

- Poor performance at work or school

- Difficulty setting priorities and making decisions

- Having an accident-prone nature

Read: Tobacco Use Disorder

Physical symptoms:

- Headaches are more frequent

- Fingers and toes are cold

- Indigestion

- Back or neck pain

- Ulcers

- Nausea

- Constipation or diarrhea

- Shortness of breath

- Heart palpitations

- Teeth grinding

- Muscle spasms

- Acne and psoriasis

Stress can contribute to many physical and emotional maladies, which should be treated by professionals. If you experience any of the above symptoms, you should seek medical treatment. In the case of overwhelming anxiety, low levels of depression, or unmanageable acute stress, you may also want to speak with Counseling and Psychological Services (401.863-3476).

Seek help: Mental Help Resources

How can college students manage their money smartly?

Develop your financial literacy now, so that you will be prepared for college and beyond. You can also use the skills and strategies to relieve economic stress and gain a sense of control over your finances.

Managing family resources

The financial support you receive from your family during college may be small or large. It is possible that your relationship with your family and how you handle money will change while you are in college. Here are a few good strategies for managing your relationships and resources:

- You may underestimate your initial expenses if this is your first time living on your own, or you may have unexpected expenses, such as a stolen phone or damaged computer.

- Making clear who will pay for what expenses: Establishing what will be covered by your family’s budget and what you will need to pay for will enable everyone to make an informed financial decision. Identify who will be responsible for the costs of tuition, books, housing, food, extracurricular activities and spending money.

- The budgeting, credit card and employment tips below will help you establish good money management habits and ensure your family’s resources are managed carefully and responsibly.

Read: Episodic Acute Stress

Budgeting

Now is the perfect time to begin budgeting your money. Setting financial goals and keeping track of your expenses is easy with a budget. You can create financial habits throughout college and beyond by setting spending limits and adhering to them.

Rather than being viewed as a contract, a budget should serve as a guideline. Simply put, a budget helps you decide how your money is best spent. If you want to have money for the things you most need and want, you must be honest with yourself about what you can afford to spend and what you need to save for.

It isn’t hard to create a budget. Online tools or software programs can be used to create your budget or you can create it the old-fashioned way using a pen and paper.

Credit cards

Sallie Mae surveyed college students nationwide in 2019 and found that 57% had credit cards. The average student has five credit cards. Students had three credit cards on average in 2016. Student debt can quickly mount when they realize how easy it is to use credit cards.

Sallie Mae surveyed undergraduates in 2019 and found that they owed $1,183 on credit cards, a 31% increase when compared with 2016. When you don’t pay your credit card bill in full and on time, interest and fees can add up quickly, so you will incur hidden charges for each purchase you make.

Use a credit card in the following manner to avoid falling into this trap:

- A check register, a small notebook, or a list on your computer can help you keep track of your purchases.

- Make sure your list matches what you’ve been charged for when you receive your credit card bill.

Keeping track of your expenditures will allow you to recognize any fraudulent activity on your account immediately, as well as unauthorized charges to your card.

It is important to be aware that the temptation to use your credit card can be very real, and despite the fact that the card is plastic, you are spending money that will need to be repaid, and, if you do not pay the balance in full each month, you will be charged interest.

Read: Work Depression

Employment during college

Work during college is often deemed a necessity by many students, and if chosen wisely, it can be a wonderful complement to your college education. Work can be a way to pay your bills while enhancing your resume at the same time.

In addition, be sure to balance it with the time and energy you need to dedicate to your studies. Consider carefully how school and employment will work together when choosing a college job(s).

It’s important to take your availability into account when considering working while in college. There are many things you can take part in outside of class, such as student organizations, campus activities, building friendships and volunteering.

Most students can work 20 hours a week or less, but each student has their own situation and it may take a while to find a balance between work and classes.

It is generally more flexible to work on-campus during your classes each semester and/or during your exam period, as on-campus jobs are more flexible and allow you to adjust your schedule as necessary. If you are unable to work as much as you had hoped, you should let your family, as well as your employer, know.

I’m really inspired together with your writing skills and also with the layout in your weblog. Is that this a paid subject matter or did you modify it your self? Either way keep up the excellent high quality writing, it is uncommon to see a nice weblog like this one these days..

After study just a few of the blog posts in your web site now, and I actually like your method of blogging. I bookmarked it to my bookmark website listing and will likely be checking again soon. Pls take a look at my website online as nicely and let me know what you think.